An engagement ring is one of the biggest purchases you’ll make in your life. While avoiding debt and paying cash is always the best way to go, you shouldn’t feel bad for financing an engagement ring. A 2018 study showed that nearly two-thirds of Americans don’t have enough to handle a $1,000 emergency expense, and considering the average engagement ring costs $5,500, it’s easy to see why financing is a popular option.

You’ve finally decided to purchase a ring, but you currently don’t have enough saved up to buy that ring she wants. In this post, we are going to help you understand how deferred interest and low interest credit card promotions work, as well as other credit card fees and terms to be aware of.

You’ve likely read a handful of inspiring stories describing how a money-savvy groom opened a 0% introductory offer credit card to purchase a stunning diamond ring for his fiancé. What those articles fail to mention is what happens when the groom doesn’t pay off the balance before the promotional period expires.

Unfortunately, most consumers don’t understand how no interest (more technically referred to as a deferred interest) credit card promotions actually work. A recent survey done by Affirm showed that out of 1,600 respondents with deferred interest credit cards, only 12% of them could answer questions correctly about how much they would owe if the balance wasn’t paid off in time.

How Do Deferred Interest Credit Cards Work?

Most jewelry stores offer a no interest (deferred interest) credit card that are provided by a handful of banks like Wells Fargo, Synchrony, Capital One and TD Bank to name a few. A typical offer seen across these is No Interest If Paid in Full Within 12 Months.

While the terms will vary between banks and retailers, the promotional terms follow a similar formula:

- You pay 0% interest as long as you pay the balance in full before the end of the promotional period

- If you don’t pay back the full balance before the promotional period ends, or if you ever make a single late payment, then you will owe interest at the standard interest rate as if it was applied from day one (notice how the offer above doesn’t even state the standard interest)

Basically, what’s happening is the standard interest (ranging from 17.99% to 28.99%) is being calculated in the background from day one. This “shadow” interest is known as deferred interest. If you don’t pay off the balance or make a single late payment then you’ll owe all the deferred interest that’s been accumulating in the background.

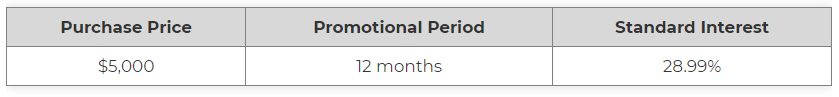

Below is a simple example of a deferred interest credit card with the following terms:

In this scenario, you purchase a $5,000 ring with a deferred interest credit card. Now, if you pay off the balance before the 12-month promotional period ends then you owe $0 in interest. However, let’s say you make payments of $417 a month, which will leave you with a balance of only $1 at the end of 12 months. Since you didn’t pay off your balance within the 12-month promotional period, your balance will jump up $785 from the deferred interest that’s been accumulating in the background. Going forward, you will be charged at the standard interest rate of 28.99% until you can pay off your balance

This is a very simple example for illustrative purposes. You can actually owe a lot more if you don’t pay off the balance shortly after the promotional period ends.

In this example, the balance is paid off shortly after the promotional period is over, and you end up paying $815 in interest (or about 16.30% of the purchase price). However, if you aren’t able to pay off the balance shortly after the 12 months is over you can owe considerably more in interest (sometimes even more than double the purchase price).

While paying 0% interest might seem enticing, keep in mind that even if you only have $1 left on your balance the day after the promotional period is over, you will be charged interest, not just on the remaining balance, but on the total, original price of the item.

Should You Get A Deferred Interest Credit Card?

On average, only about 75% of deferred-interest offers were paid down in full before their promotional period ended between 2009 and 2013, according to the most recent data available from the Consumer Financial Protection Bureau. The payoff rate was considerably lower for customers with low credit scores, where only about 50% of customers paid off their balance in time.

After talking to a jewelry store salesperson, you’re not confident you can pay off the balance within 12-months on a no interest credit card, and you would prefer to pay off your ring through another common jewelry store financing promotion: the low interest store credit card.

How Does A Low Interest Credit Card Promotion Work?

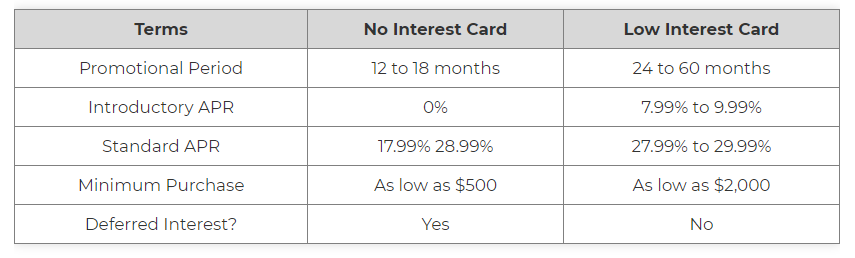

Generally speaking, low interest credit card promotions offer longer terms, has a higher introductory APR and requires higher minimum purchases. However, the biggest difference from a no interest credit card promotion, is that low interest credit cards typically don’t charge deferred interest. Which means, if you don’t pay off your balance before the end of the promotional period or if you make a single late payment, you will not be charged interest retroactively on the entire amount from the initial date of purchase.

Instead, your APR will jump to the standard APR of around 28.99% (which, mind you, is nearly double the national average credit card rate of 16.15%) until the remainder of your balance is paid off.

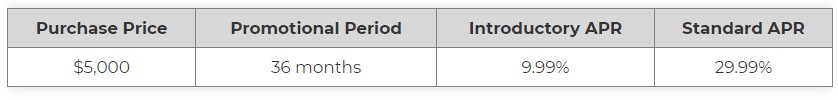

Below is a simple example of a low interest credit card with the following terms:

In this scenario, you purchase a $5,000 ring with a low interest credit card. As long as you don’t make a late payment, you will pay 9.99% for the first 36 months and 29.99% thereafter until the balance is paid off.

Interest rates are far less of a punishment compared to a no Interest credit card, but you definitely want to make sure you can pay the balance off in time since the longer term means that there’s more time for you to fall behind and therefore more time for interest to accrue on your balance.

Should You Get a Low Interest Credit Card?

Paying 9.99% over 36 months is a relatively low interest rate to pay (although you can find better rates elsewhere) if other financing options are not available. If you are absolutely confident that you can allocate enough of your monthly income to make payments well above the minimum payment over several years, then a low interest credit card could be right for you, but with the possibility of unpredictable expenditures, especially planning a wedding, we highly recommend you consider financing with Gage Diamonds.

Here’s a breakdown of the topline differences between a no interest credit card and a low interest credit card:

How Jewelry Credit Cards Can Hurt You

While we’ve laid out the general differences of no interest and low interest credit cards offered by most jewelers, it’s important to keep in mind that like any credit card, the fine print matters. These promotions come with terms like minimum payments, fees, and can certainly impact your credit.

1. Minimum Payments

Most credit cards will have a minimum monthly payment that’s either a fixed amount, or a percentage of the current balance, typically whichever is greater. While making the minimum payment helps you avoid late fees (and triggering the standard interest rate!), making these minimal payments will barely pay down your balance. Furthermore, for every minimum payment you make, you’re just digging yourself in a bigger hole that’ll you need to climb out of by making a big catch-up payment down the road. Of course, if you don’t make that catch up payment, then you’ll end up paying a lot in interest.

As a fairly extreme example, we’ve outlined how long and how much it would take to pay off a $5,000 balance at various APRs, if you paid 2% of the balance every month. If you paid 2% of your balance on a 20% APR card, it would take you a whopping 56 years to pay off your balance and you’ll end up paying $22,000 in interest or 440% of your purchase price!

2. Other Fees to Be Mindful Of

So far, we’ve been focusing on the interest component of jewelry store credit cards. Another thing to be mindful of are the other fees that these credit cards tack on. Most credit cards will charge late fees of up to $39 for every late payment as well as return fees of up to $39 if your payment gets returned. This can be a pretty big triple-whammy if one of your payments get returned, since you’ll pay $78 in fees and you’ll have to start paying the standard interest rate.

3. Impact on Your Credit Score

Jewelry financing options are nothing more than credit cards with lofty names. This means that they affect your credit score just as any other credit card would. Here are four ways in which financing your jewelry might affect your credit:

Your Credit Utilization Ratio Might Increase

If you don’t have any credit history, opening a new line of credit through a retailer won’t necessarily hurt your score if you pay off the maxed-out credit card as quickly as possible. If, on the other hand, you don’t pay it off quickly, your credit utilization ratio will be relatively high for an extended period of time. Since your credit utilization ratio has around a 30% impact on your score, you don’t want this ratio to be high for long.

The Average Age of Your Credit History Can Decrease

The average age of your credit history matters to lenders for a couple of reasons. For one, they can more easily evaluate the risk of lending to you if your credit history is long and detailed enough. And the second reason? The average age of someone’s credit history, which has a 15% impact on credit scores, tells lenders a lot about how often that person opens up new lines of credit. A low average age indicates that someone frequently opens new lines of credit, meaning that this person isn’t necessarily the most responsible borrower. So, if you’re someone who doesn’t want the average age of your credit history to decrease? You might not want to finance that jewelry with a credit card.

Inquiries by Lenders Can Hurt Your Score

When you apply for a credit card, mostly all credit card companies will perform a hard credit inquiry in order to determine your credit-worthiness. Hard inquiries can lower your credit score slightly and hard inquiries stay on your credit report for 2 year

Cancelling a Credit Card Can Knock Your Score Down

The good thing about loans is that you’re done with them forever once you pay off your loan. Credit cards don’t provide borrowers with this luxury; once a line of credit is open, it’s open even after you’ve paid it off. You have to actually cancel it to get rid of it.

But, unfortunately, canceling a credit card can knock your score down a few points, especially if you have outstanding balances on your other cards.

The Difference at Gage Diamonds

Buy now and pay later with Gage Diamonds. We offer financing at 4.95% for 12 or 24 months on everything from engagement rings and diamonds, to fine jewelry and wedding rings. We have an exclusive in-house financing partner, LendFirm, and we make our “interest” by buying products at wholesale prices and selling them at a competitive retail price. This allows us to provide a straightforward financing option for shoppers with low credit scores.

We use a holistic approach to determine if a customer is a good candidate for financing. We know that your financial health is made up of far more than your credit score, so we look to see if you have a steady source of income (at least three months of employment or income history) and can spend responsibly (having a checking account in good standing with few overdrafts and negative balances).

How Easy is it to Get Financing through Gage Diamonds?

At Gage Diamonds, we don’t turn away customers simply because they have less-than-stellar credit. All we ask is that you have the following three things:

- A valid driver’s license or State ID

- Direct deposit from your primary employer or benefit provider into a checking account with at least 3 months of history

- Checking account in good standing (no excessive NSFs, overdrafts and negative balances)

It’s that simple. As long as we can verify your information, then you’ll have a good chance of getting approved regardless of your credit history. The best part is that you can get approved in less than 24 hours and start shopping at Gage Diamonds for that special engagement ring.

We link directly to your checking account and automatically debit payments on the same day you get paid so that you’ll never have to worry about making payments. Plus, it reassures us that you’ll have the funds to make your payments (we like to get paid too!). By automatically syncing the payments to your pay dates, we are able to offer feeless financing as low as 4.95% APR for up to 24 months to our customers.

Have a question? We can help!

Gage Diamonds is Chicago's premier jewelry showroom and online retailer of engagement rings, wedding bands, and fine jewelry. We offer a selection of dazzling handpicked diamonds in a variety of shapes, including oval, pear, marquise, emerald and princess.

We’re committed to helping you find the ring of your dreams. For inspiration, browse our website or set up an appointment with a member of our trusted staff at our in-person showroom.

We offer no-credit-needed financing – feel free to apply and get your approval within 24 hours!

Pay over time, because love shouldn’t wait.